Happy Monday from Las Vegas, Nevada 🌞

I hope your week is off to a great start!

As happens frequently, I stumbled into the work of a great new business/investing writer since I wrote my last email.

This week’s edition covers the most interesting ideas I’ve learned from burning through a lot of his content this past few weeks.

Enjoy!

But First… Some Miscellaneous Updates

Last week, I had an awesome family reunion with relatives I haven’t seen since before pandemic insanity. Very grateful to see them again!

I’m full steam ahead in my search for an exciting remote role related to Crypto/Web 3.0/DeFi/Bitcoin. If any opportunities jump out at you, please send them my way!

I’m open to a wide variety of job types: software/engineering, investment research, content creation, business dev/sales/partnerships, or really anything else where you think I’d be a great fit 🤷♂️

The podcast crossed 200 YouTube Subscribers and is just shy of 30k combined views + audio downloads🎉

… Onto the Newsletter

5 Not Boring Ideas I Learned This Week

Not Boring author Packy McCormick sends two essays per week to 70,000 people.

On Mondays, he shares a deep dive on a publicly traded company or a macro-trend.

On Thursdays, he shares “not boring” investment memos explaining his rational for investing in various startups.

These essays are engaging ways to learn about business, investing, and stay up-to-date on changing industry landscapes (often tech oriented).

I’ve seen Packy McCormick on Twitter for 6+ months, but I never took the time to read any of his work.

That changed this week when I found out he recorded a podcast version of his essays.

Here’s what I learned from devouring about six of his best episodes ⬇️ ⬇️ ⬇️

1) Indexed Bets On Underlying Trends (not financial advice)

This concept is familiar to anyone who’s invested in public stocks.

Warren Buffet suggests that many investors just buy the S&P 500 instead of picking stocks. Instead of trying to pick winners, you just need to believe in the underlying trend of growth in the US economy.

Packy uses the same lens to decide whether certain individual companies are investable.

Think of your home Wi-Fi provider and your favorite streaming platform. Regardless of who is still around in 3 years between Netflix, Hulu, Disney, Peacock, etc, you still need to pay for internet. The underlying business need is a theoretically safer investment than the various services built on top of it.

Packy would call this phenomenon an indexed bet, and his Not Boring newsletter frequently praises companies that meet this description. In his view, firms providing infrastructure are positioned to win regardless of specific outcomes of the people that use the infrastructure in question. Let’s look at another example.

Example: Amazon Kindle vs Louis’ First Novel

Would you rather buy a share of Amazon’s book marketplace or bet on the success of my first book? The Amazon bet is profitable as long as people continue to buy books on Amazon (which seems very likely). The success of Louis’ Novel is very unpredictable. Investing in Amazon is an indexed bet on online book purchasing.

When you make an indexed bet, you are wagering that there will be demand—not what will specifically be demanded.

Example: Cloud Computing vs Random SaaS Startup

You don’t know which random SaaS Startup will gain traction, but you can be reasonably confident that every SaaS startup is going to need some cloud services to scale their architecture. Cloud Computing companies would therefore be an indexed bet.

With indexed bets, you don’t pick winners, pick underlying trends.

Caveat: Indexed betting also has risks. If, hypothetically, everyone switched their home wifi to magical satellites, then the local wifi provider might die, whereas the streaming providers wouldn’t be affected. Indexed betting is still betting—of course.

2) Irrelevant Inconvenience

Axie Infinity is an extremely fast growing video game (understatement).

Within the past few months, the game went from relative obscurity to having hundreds of thousands of daily players and earning millions in monthly revenue.

Most Mobile, PC, or Console games are extremely easy to start playing. Assuming you have the equipment, you just buy a disc or download some software (that is frequently free). Then, you start playing pretty much immediately.

Unlike most video games, however, the barriers to entry for Axie are extremely high.

Before starting, players need to obtain cryptocurrency, self-custody that cryptocurrency, migrate some of it to a different blockchain, purchase at least 3 of the games characters (the cheapest character is $216 USD at time of my writing this), and then download the game and start playing.

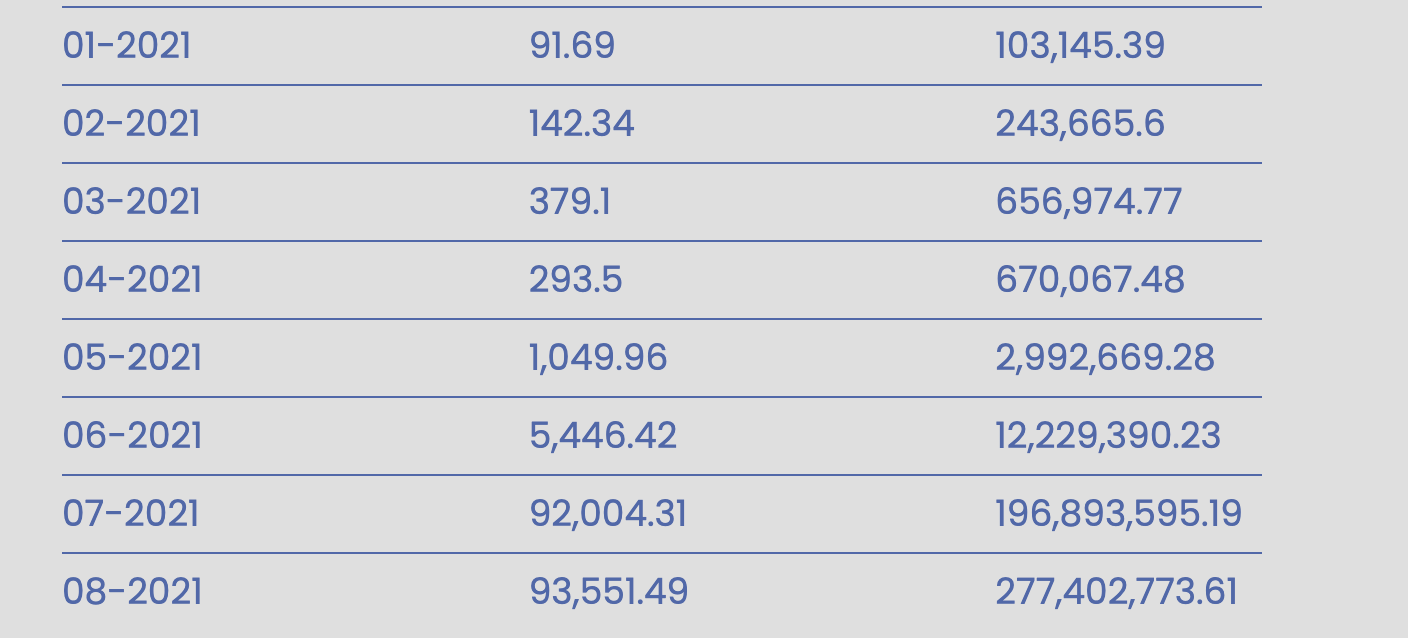

Despite this difficult adoption process, the game has grown like crazy. I’ve put their monthly revenue numbers below. The far right column is revenue in USD.

100k in January. 3 million in May. Almost 300 million in August.

Packy observes that when something is “growing like crazy” despite being massively inconvenient (>600$ setup costs), and difficult, it is probably worth paying attention to.

In the early days of bitcoin, people were losing wallets, getting hacked, and had an extremely high learning curve to get started. The fact that it emerged was a tribute to its utility.

Tesla is another example. In the early years, Tesla owners faced significant inconveniences relative to gas car owners. Customers were fanatical enough to do it anyway.

Pay attention when something is growing despite massive obstacles, inconveniences, and every other reason to not succeed.

3) You Already Know Enough To Start Sharing Ideas

In listening to Packy, I heard him repeat the same two mental models/ frameworks in pretty much every breakdown: The Lindy Effect and The Bill Gates platform.

Quick Summary—Bill Gates

Bill Gates platform: “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it” (Source)

Facebook, Amazon, and Twitter could all be considered platforms. The economic value that occurs on the platform exceeds the underlying value of the platform itself.

Quick Summary—Lindy Effect

Lindy Effect: “The Lindy effect… is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes the longer a period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy.” (Source)

Plato and Marcus Aurelius are much more likely to be remembered 100 years from now than Tucker Carlson, AOC, or Ben Shapiro. The fact that they’ve been around so long makes it more likely that they’ll continue to be around.

Why am I bringing this up?

Some of Packy’s breakdowns might be a bit repetitive to me, but I don’t care.

He’s in the arena, he’s playing the game, and he’s making really interesting work.

Packy could just as easily have waited a few more years to start sharing his thoughts once he “knew more” or was considered an “expert.” Instead, he’s been publishing for almost 3 years and now he’s crushing it—growing by almost 1,000 subscribers per week.

So many people are hesitant to start creating content and putting themselves out there online. Why?

You, right where you are right now, probably know enough to be useful to some audience.

You probably have some ideas worth sharing.

Bias Toward Starting. Bias Toward Publishing. Bias Toward Action.

4) Authenticity, Relatability, Likability

As content creation becomes increasingly individualized and fragmented, we get more and more of our news and entertainment from people, and people’s lives are complicated.

Packy has had a babbling newborn in the background of a few of his narrations. He shares personal connections to the businesses, entrepreneurs, and products he discusses whenever possible.

In this newer media consumption environment, we trust and develop affinity for the creators who show up as themselves.

Packy comes across as a regular guy who has valuable insights into startups and technology.

CNBC anchors come across as starchy, corporate, and questionably motivated.

The same is happening in regular news media as well.

Mike “Communism is for Incels” Solana’s news coverage is authentic and believable.

MSM channels like Fox and CNN come across as folks in studios that are instructed to support their company agenda’s and increase watch time with sensationalism.

I believe we will continue to see the rise of trusted individual creators and a decrease in faith in massive institutions. I think mid-sized companies small enough to retain a clear voice and personality like Bitcoin Magazine or Morning Brew will continue to thrive as well.

In 2021, there are just too many choices for stiff, questionably ethical, corporate media companies to continue to thrive. Everyone can hack together their own information diet from sources that are likable, authentic, and relatable.

Because of his authenticity, I’ve chosen to add Packy into my consumption calendar.

5) Meta-Lesson: Switch The Medium

I’ve heard good things about Packy for months, but since I rarely commit to super long articles, I never explored his work.

Once I found out his stuff was packaged in audio, I made it through hours of content because I have a lot of passive audio consumption time in my life (driving, exercising).

Sometimes the key to getting yourself to consume something is changing it to a format that better suits your life.

Almost every idea and subject matters is available in every media format.

Video, Audio, Short Form, Bite Sized, Long Form, Print, eBook etc.

Start sending articles from the internet to your kindle. Print out textbook chapters if you really want to read deeply. Find a video course if your textbook is too boring. Don’t assume there isn’t a better way!

One of our past podcast guests, Guy Swann, has made a name for himself in crypto just by being a fantastic voice actor. His podcast, Bitcoin Audible, is just him narrating the best articles in bitcoin, so you don’t have to read them for yourself. Same content, different medium.

If you are stuck, try changing the format.

As they say, “the medium is the message.” (McLuhan)

Thank You For Reading!

I’m planning on taking next week off. I’m taking a long drive/vacation/moving this Thursday - Sunday, and I don’t want to add the newsletter into the mix.

Until next time,

Louis

Quick Clicks

(1) Book Recommendation: Amusing Ourselves To Death By Neil Postman

I read this in 2017, but the McLuhan quote reminded me of it. This book (written in 1984) is unbelievably prophetic about the decline in substantive thought in America caused by our collective obsession with entertainment.

(2) Educational Resource: Crypto Zombies Solidity Smart Contract Tutorials

Solidity programming (Ethereum’s coding language) seems to be in very high demand. I’ve heard from multiple people that this is one of the best courses. I’ve also done about 15% of it and found the content to be really good.

(3) Get In Packy’s World

Twitter, Not Boring Newsletter, Not Boring Podcast

Photo Of The Week — I’m Running My Own Node!

This jumble of hardware will soon become part of the Bitcoin network after it synchronizes the history of the blockchain.

I’m using the Umbrel software to guide my project if you are curious for parts lists and any other relevant details!

Great edition!

Loved this edition, Louis—and more motivated than ever to read through, er, listen to Packy's work! I didn't know he did a podcast version. That's the platform I do my longform consumption in as well. Great takeaway from you at the end there as well about changing the platform 👌